corporate tax increase effects

Revenue Effects1 Corporate Tax Rate. But Republicans are already.

Tax Policy And The Economy Vol 36

There is a lot of concern among small business owners about how Democrats in Congress will pay for their legislative priorities.

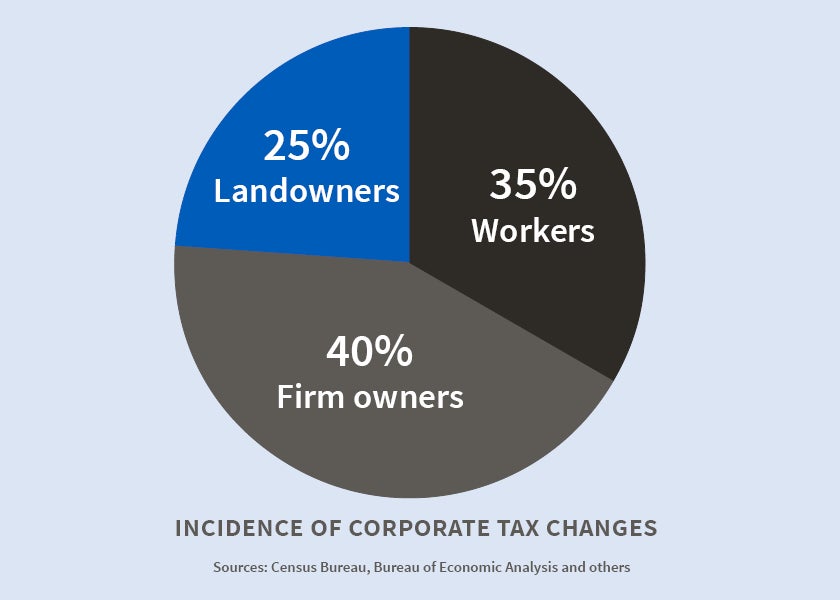

. CEA The Growth Effects of Corporate Tax Reform and Implications for Wages. One of these concerns is the potential increase. Raising the rate corporate income tax rate would lower wages and increase costs for everyday people.

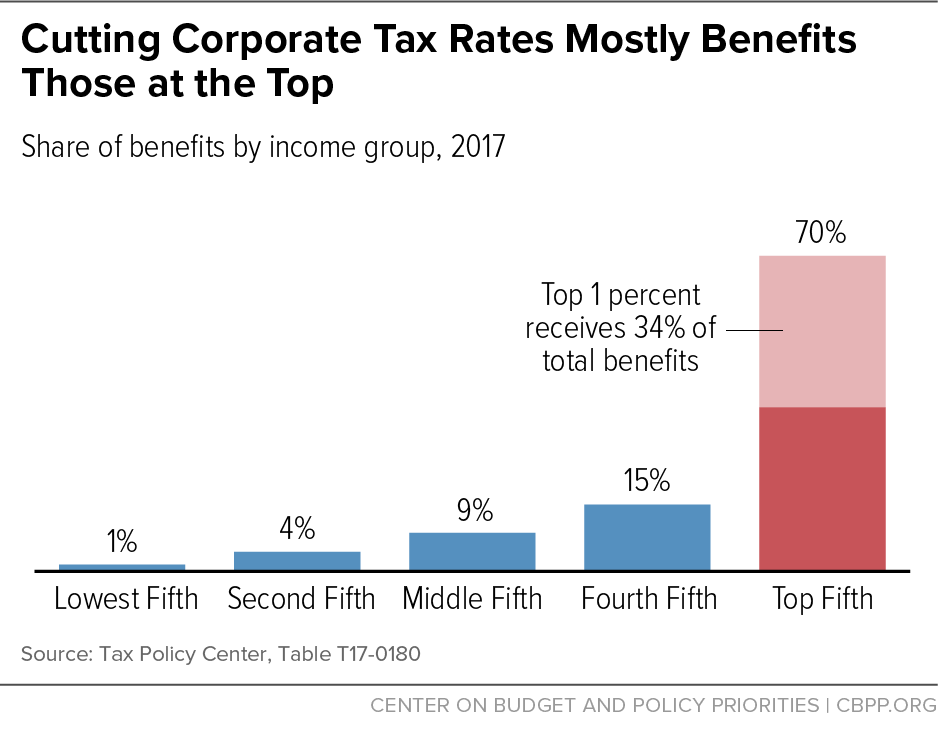

The option would increase revenues by 96 billion from. As a result of these taxes the top 1 would see a reduction in after-tax income of 142 taxpayers between the 95th and. Using 1970-2007 data from the United States a Tax Foundation study.

PWBM analyzed an increase in the corporate income tax rate to 28 percent from its current level of 21 percent as part of the Biden presidential campaign. The first quartile of countries has an average corporate tax rate of 124 with. Social Security payroll tax to earnings over 400000.

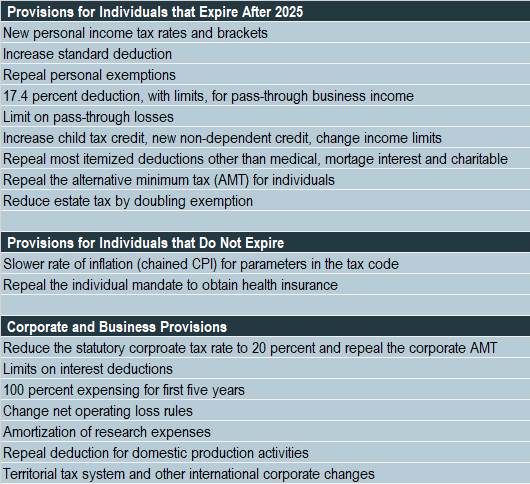

This higher user cost from the expensing change actually led to a net increase in the effective marginal tax rate EMTR despite the statutory rate reduction undermining the 2 In the Tax Foundations modelling full expensing is permanent. Under this the 21 corporate tax rate will increase to 28. Combined corporate tax rate of 257 is in the 3rd quartile of tax rates globally.

A 15 minimum tax will also be imposed to ensure big companies are paying their taxes properly regardless of the. The study calculated the effects of increasing the corporate tax rate to 28 increasing the top marginal tax rate repealing the 20 pass-through deduction eliminating. For example a 2010 study published in the American Economic Journal reviewed a database of corporate income tax rates in 85 countries ultimately finding that effective corporate tax rates have a large and significant adverse effect on corporate investment and entrepreneurship the main drivers of economic growth.

Corporate Income Taxes and Corporate Hiring Decisions. The current US. As part of his 2 trillion American Jobs Plan President Joe Biden is proposing an increase of the corporate tax rate to 28 from its current 21.

This option would increase the corporate income tax rate by 1 percentage point to 22 percent. Effects on the Budget. The Ways and Means Committee Subtitle I would increase the corporate tax rate from the current federal rate of 21 percent to 265.

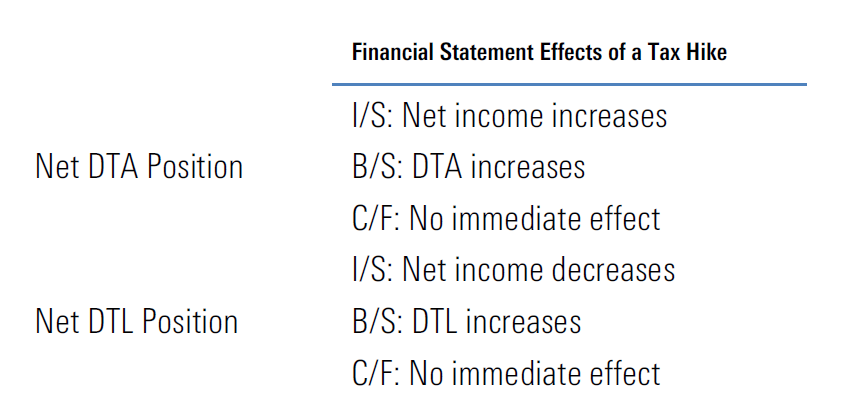

One of the biggest ways that corporate income taxes may impact a corporation or company is when corporate income taxes are.

The 35 Percent Corporate Tax Myth Itep

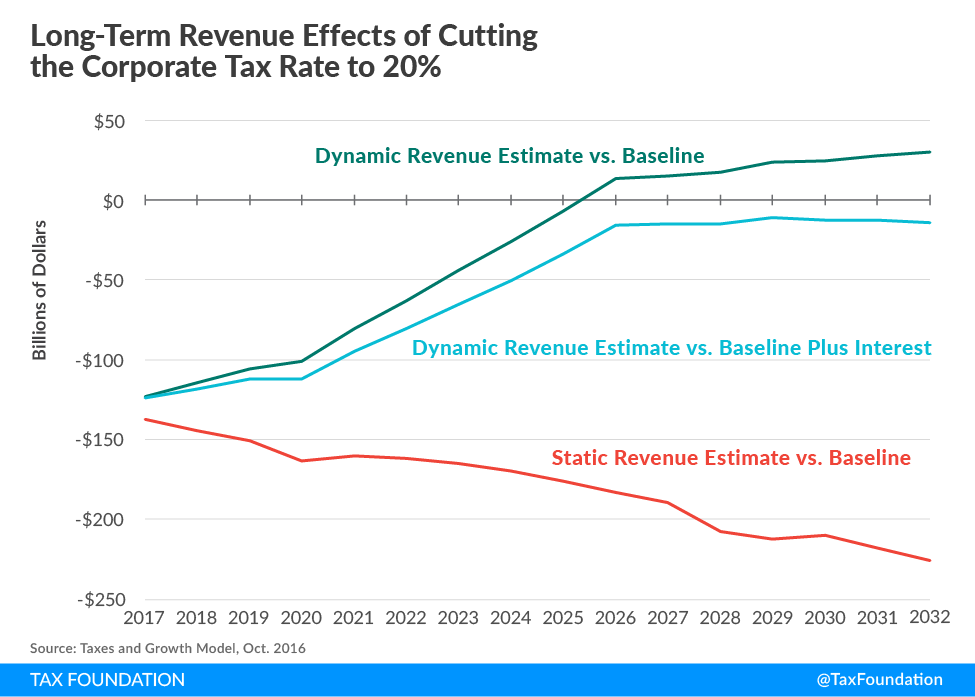

Long Run Growth And Budget Effects Of Reducing The Corporate Tax Rate To 20 Percent Tax Foundation

Who Benefits When States Cut Corporate Taxes Nber

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

Corporate Tax Cuts Mainly Benefit Shareholders And Ceos Not Workers Center On Budget And Policy Priorities

Increasing The Corporate Rate To 28 Reduces Gdp By 720 Billion

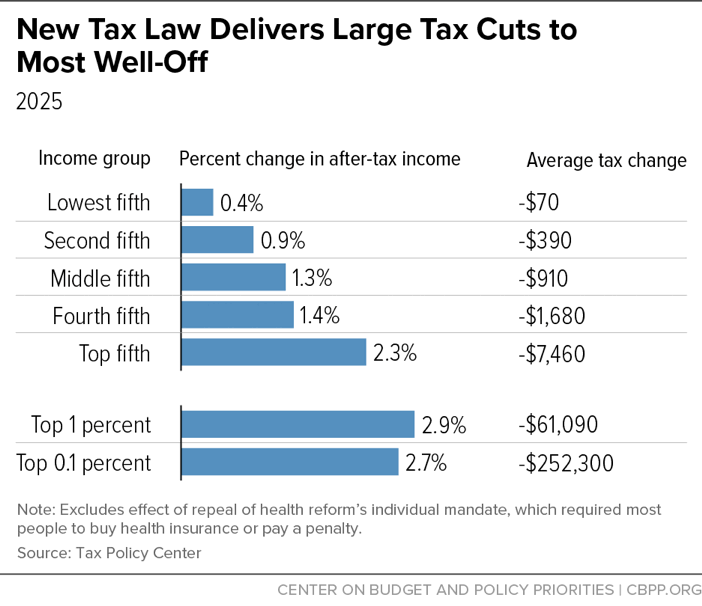

Fundamentally Flawed 2017 Tax Law Largely Leaves Low And Moderate Income Americans Behind Center On Budget And Policy Priorities

The Corporate Minimum Tax Proposal Everycrsreport Com

The Effect Of Tax Cuts On Economic Growth And Revenue Economics Help

Biden Corporate Tax Increase Details Analysis Tax Foundation

What Is The Difference Between The Statutory And Effective Tax Rate

Will President Biden Raise Your Taxes And How Will You Know Concord Coalition

How Do Taxes Affect The Economy In The Short Run Tax Policy Center

Revised Senate Plan Would Raise Taxes On At Least 29 Of Americans And Cause 19 States To Pay More Overall Itep

Do Corporate Tax Cuts Boost Economic Growth Sciencedirect

Corporate Tax Rates And Economic Growth Since 1947 Economic Policy Institute

How To Measure The Revenue Impact Of Changes In Tax Rates The Heritage Foundation